From Audit to Action: A Roadmap to Maximum Energy Savings

Translate Findings into a Prioritized Portfolio

Sequence the Work for Minimal Disruption

Respect Technical Dependencies

Plan Seasonal Windows

Communicate Blackout Calendars

Finance Smartly and Leverage Incentives

01

Stack Rebates Without Double-Counting

Map each measure to eligible programs, minding baselines, pre-approval rules, and measurement requirements. Coordinate with utilities early to lock incentives, and avoid overlapping claims across custom and prescriptive paths. Documentation discipline can add significant value, easing audits later and protecting your savings narrative for stakeholders and investors.

02

Match Funding to Measure Lifespan

Short-payback items fit internal cash or revolving green funds, while long-lived assets align with low-interest debt or service agreements. Paired this way, annual savings cover obligations, and future upgrades remain affordable. Include warranties and maintenance contracts to safeguard performance throughout the financing horizon and beyond.

03

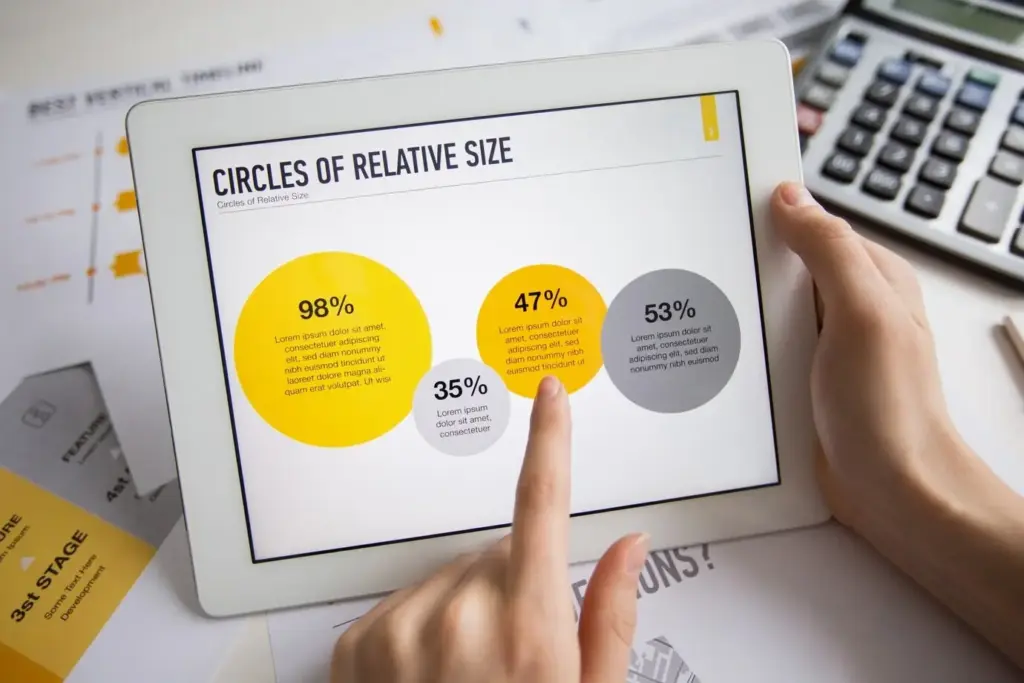

Model Cash Flow Scenarios

Stress-test assumptions for energy prices, occupancy, and weather. Simulate conservative, expected, and stretch cases, then visualize debt service coverage through time. Showing resilience under different conditions builds confidence with boards and lenders and helps prioritize the project mix that protects liquidity while still achieving emissions and comfort goals.

Choose the Right IPMVP Option

Build an Operator-Friendly Dashboard

Close the Loop with Recommissioning

People Power: Training and Behavior

Mitigate Technical Risks Early

Assure Quality with Clear Standards

Measure What Matters and Share Results